Vat Registration Saudi Arabia

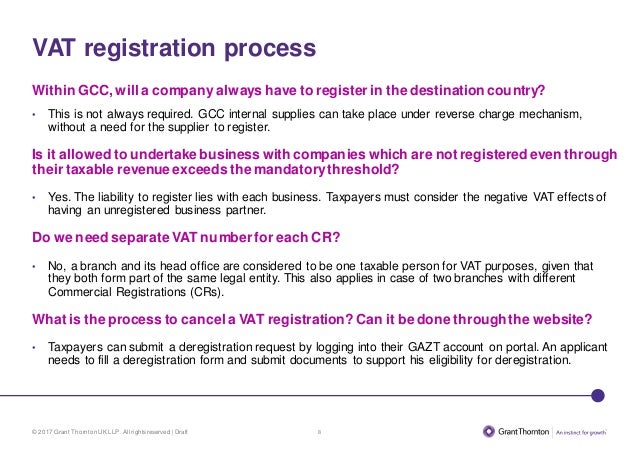

Group registration is the process by which 2 or more legal persons apply grouped for vat treatment.

Vat registration saudi arabia. The kingdom of saudi arabia ksa is one among the 2 member states of gcc to implement vat on 1st january 2018. This was based on the gulf co operation council s vat treaty which sets the broad parameters for the role out of vat across its 6 member states. The group is treated as a single taxable person with consolidated supplies and joint responsibility if the general authority of zakat and tax gazt approves the group registration application.

Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. Get professional assistance for vat registration services in saudi arabia. Vat registration in saudi arabia.

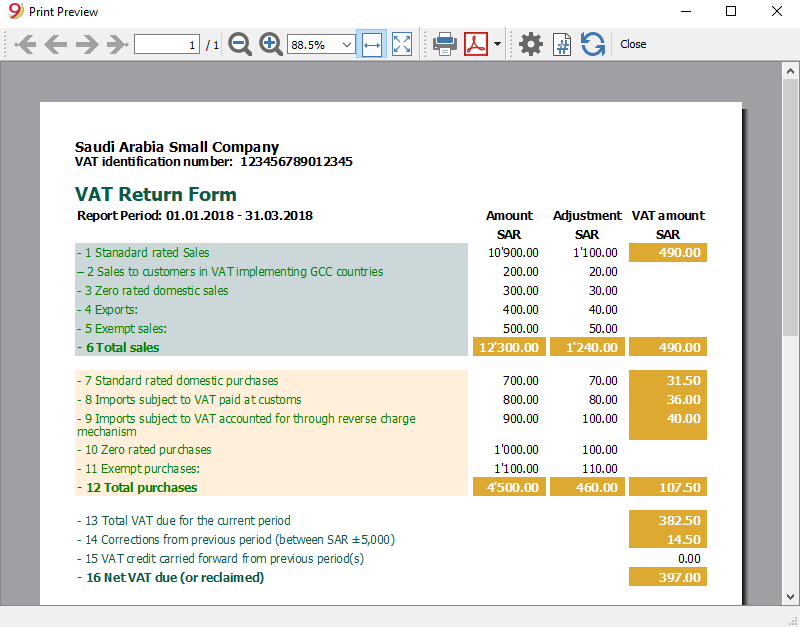

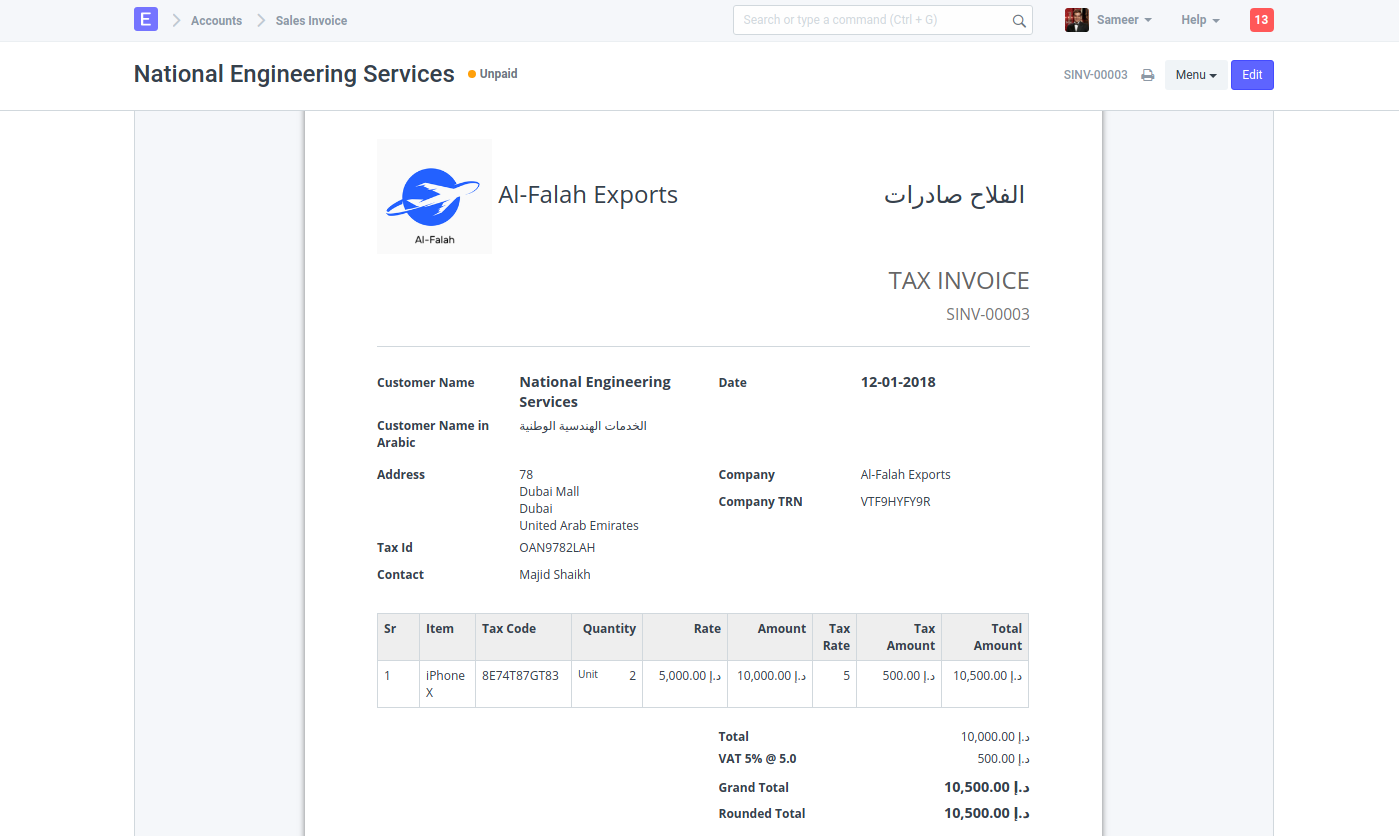

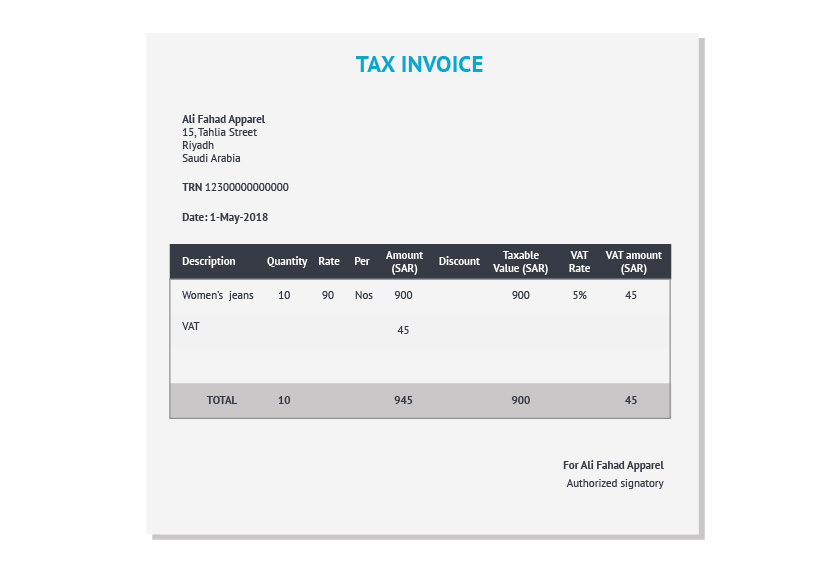

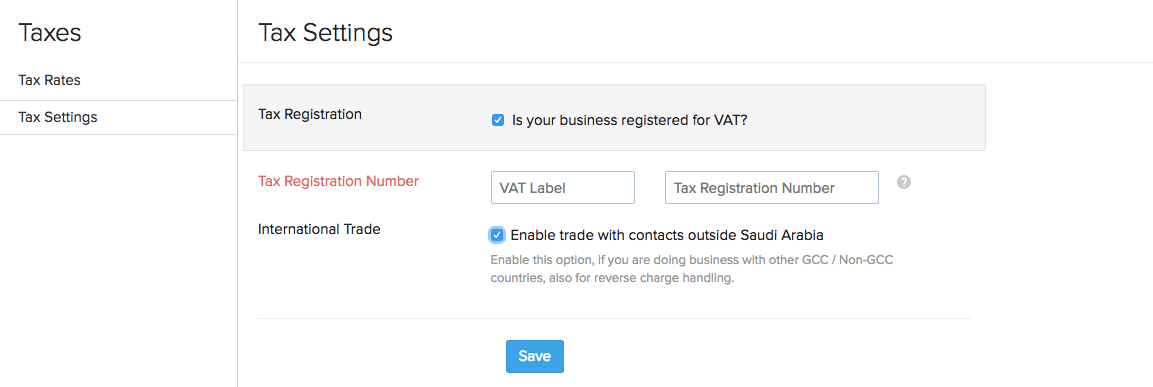

With the implementation of vat the businesses in ksa are expected to be vat compliant by following the guidelines as prescribed in the saudi arabia vat law and the implementing regulations. Value added tax vat value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. Saudi arabia implemented a value added tax regime on 1 january 2018.

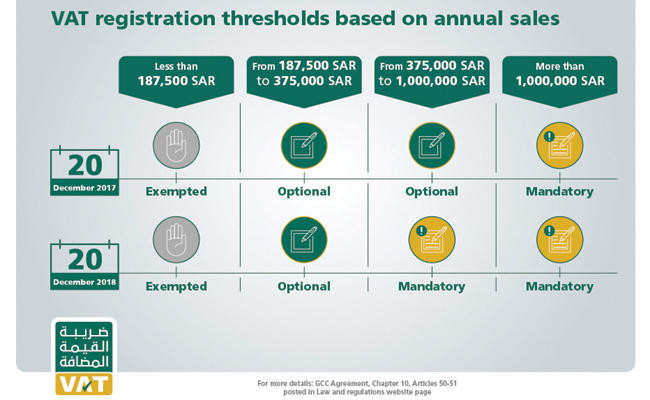

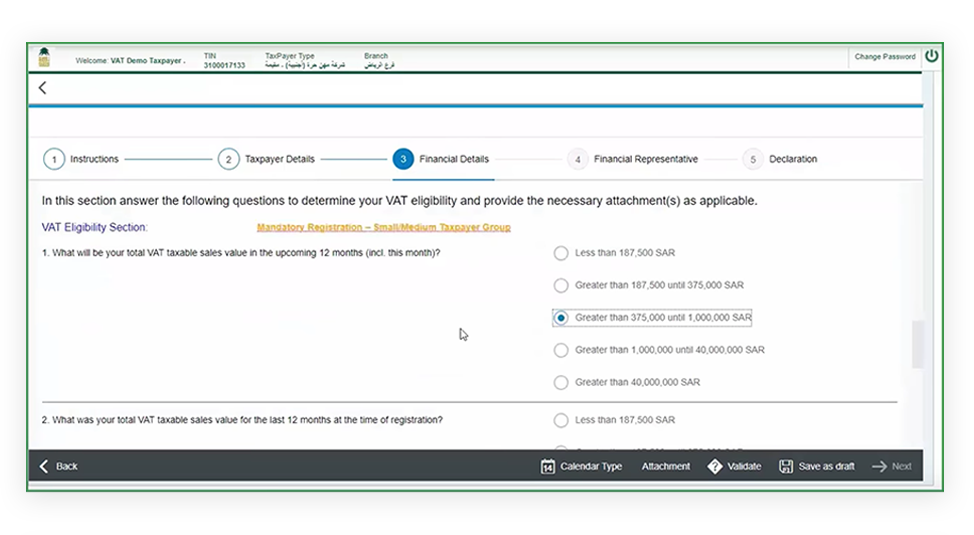

Those businesses who have a residence in saudi arabia and the taxable supplies value exceeds sar 375 000 in the preceding 12 months need to register under saudi vat mandatorily. Businesses not having a residence in saudi arabia have to register under vat irrespective of the registration threshold. More than 150 countries around the world have already implemented the vat.

Some of the key highlights are listed below. Verification of registration in vat general authority of zakat and tax a service that enables the public and authorities to verify that beneficiaries have registered in the vat and received a registration certificate. The kingdom of saudi arabia ksa has released its final value added tax vat law on the website of its official gazette on friday 28 th of july.

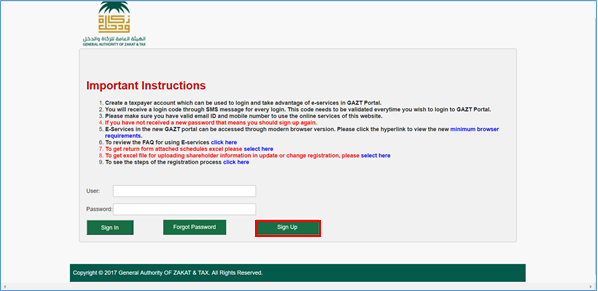

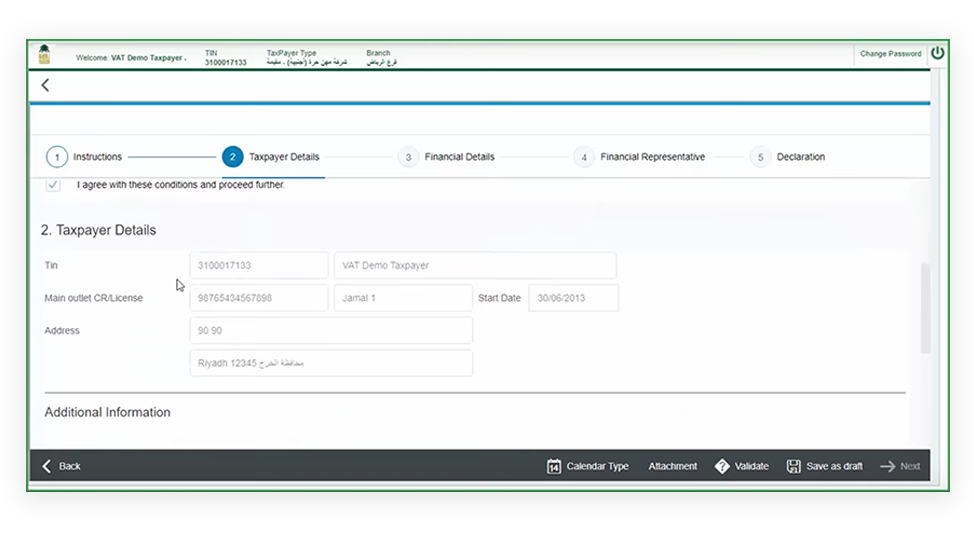

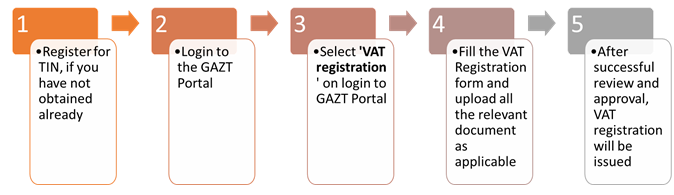

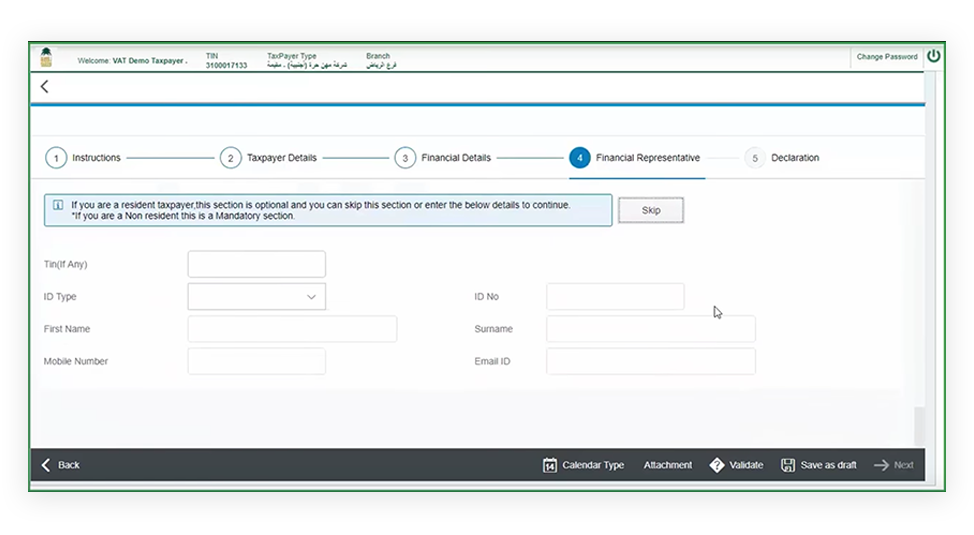

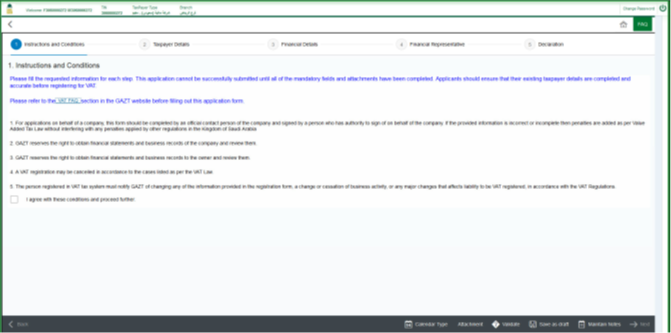

The vat registration in ksa is a 5 step process let us understand the steps to apply for vat registration in saudi arabia in detail. What is group registration. Value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions.

According to article 2 and in alignment with the gcc vat framework agreement all imports into and supplies of goods and services in the ksa will be subject to vat. Uae 800 82559 saudi 800 2442559 bahrain 800 12559 mena.