Vat Registration Certificate Saudi Arabia

Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets.

Vat registration certificate saudi arabia. Businesses must evaluate if they have exceeded the threshold on a monthly basis. Value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. Chamber of commerce and industry membership 4.

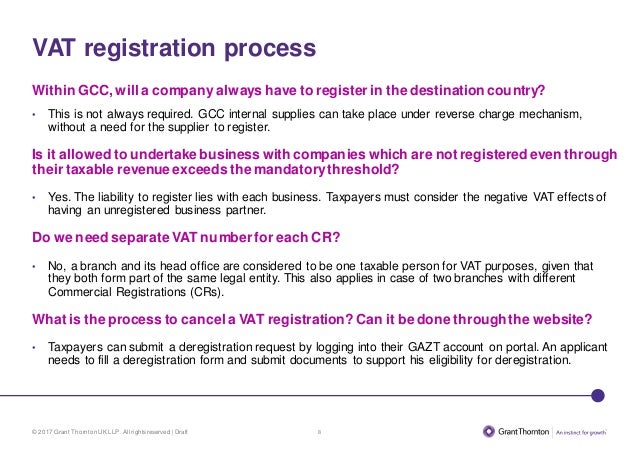

Verification of registration in vat general authority of zakat and tax a service that enables the public and authorities to verify that beneficiaries have registered in the vat and received a registration certificate. Valid zakat and income tax payment or clearance as well as value added tax vat registration certificate. Saudi arabia s general authority of zakat and tax require resident and non resident businesses performing taxable supplies to register within 20 days of passing the vat registration threshold.

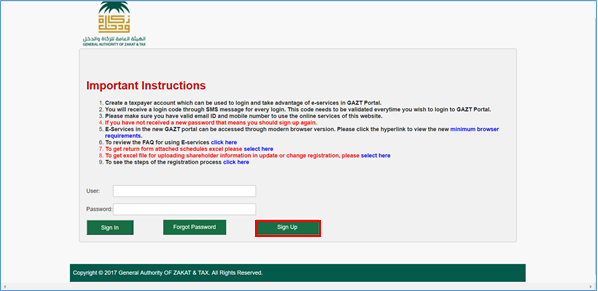

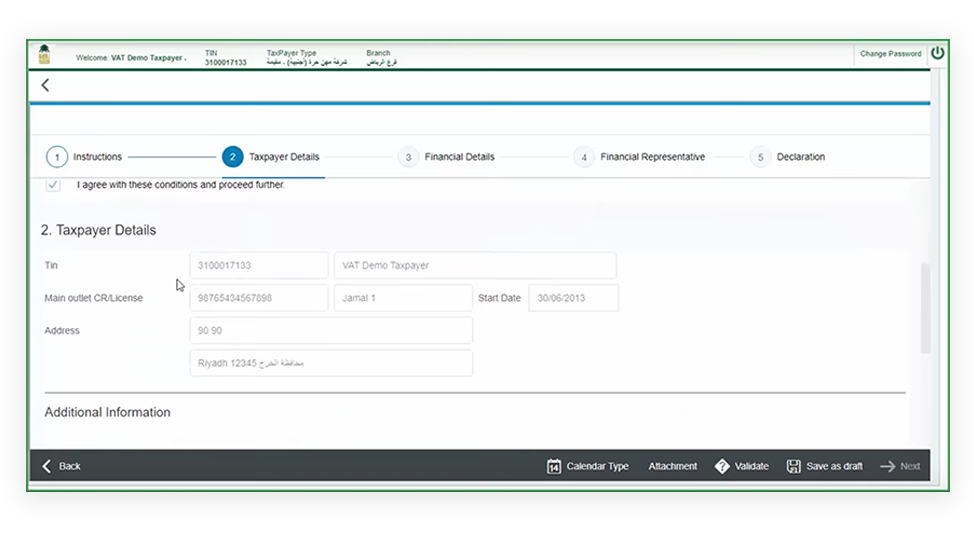

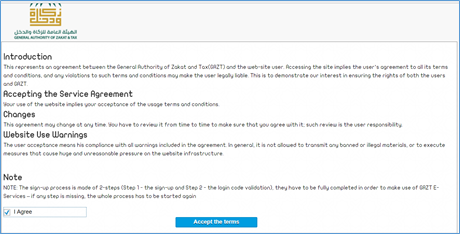

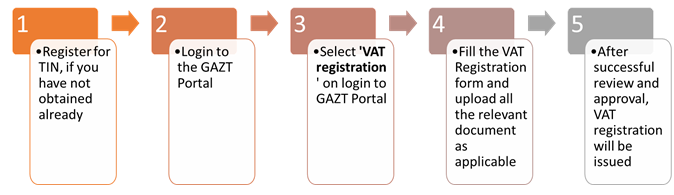

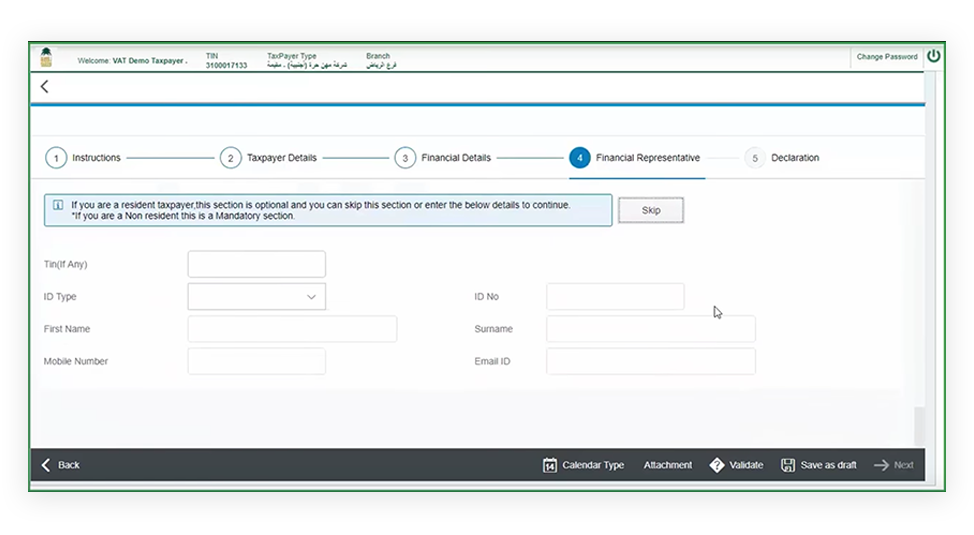

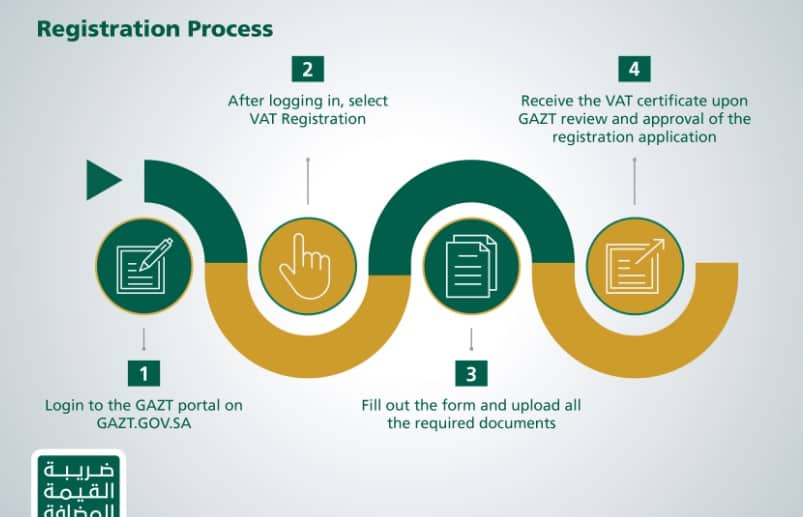

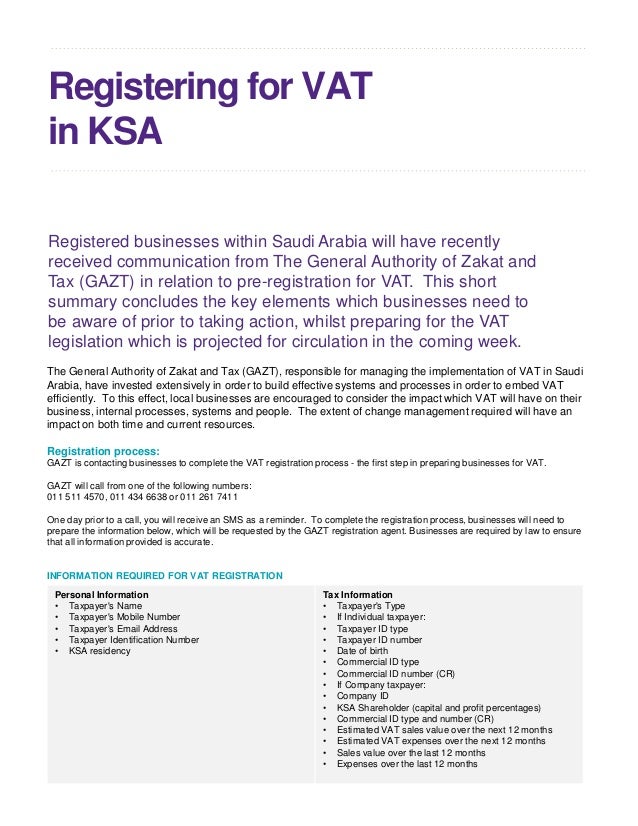

With the implementation of vat the businesses in ksa are expected to be vat compliant by following the guidelines as prescribed in the saudi arabia vat law and the implementing regulations. Uae 800 82559 saudi 800 2442559 bahrain 800 12559 mena. The vat registration in ksa is a 5 step process let us understand the steps to apply for vat registration in saudi arabia in detail.

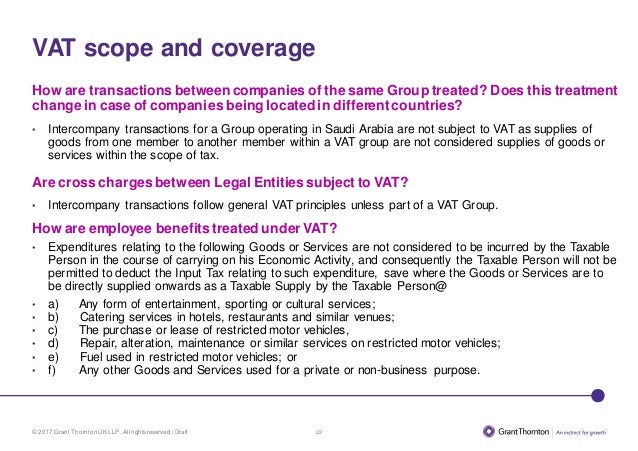

Suppliers who are registered in the vat system of the general authority of zakat tax in accordance with the ksa vat law and regulations must report vat registration number and supply a copy of vat. Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. Vat group registration certificate.

The kingdom of saudi arabia ksa is one among the 2 member states of gcc to implement vat on 1st january 2018. Sabic group vat certificate in accordance with the framework agreement between gcc countries value added tax vat has been implemented in the kingdom of saudi arabia since january 1 2018.

From 28 august onwards all those liable or eligible to be registered for value added tax vat in the kingdom of saudi arabia ksa will be able to make use of erad to complete and lodge their vat registration application.