Vat Invoice Saudi Arabia

Modern products co jeddah industrial area no 4 saudi arabia tax special number.

Vat invoice saudi arabia. Free saudi arabia vat invoice format. M 51 dated 3 4 1438 h. This is the address that must appear on the envelope containing the invoice s.

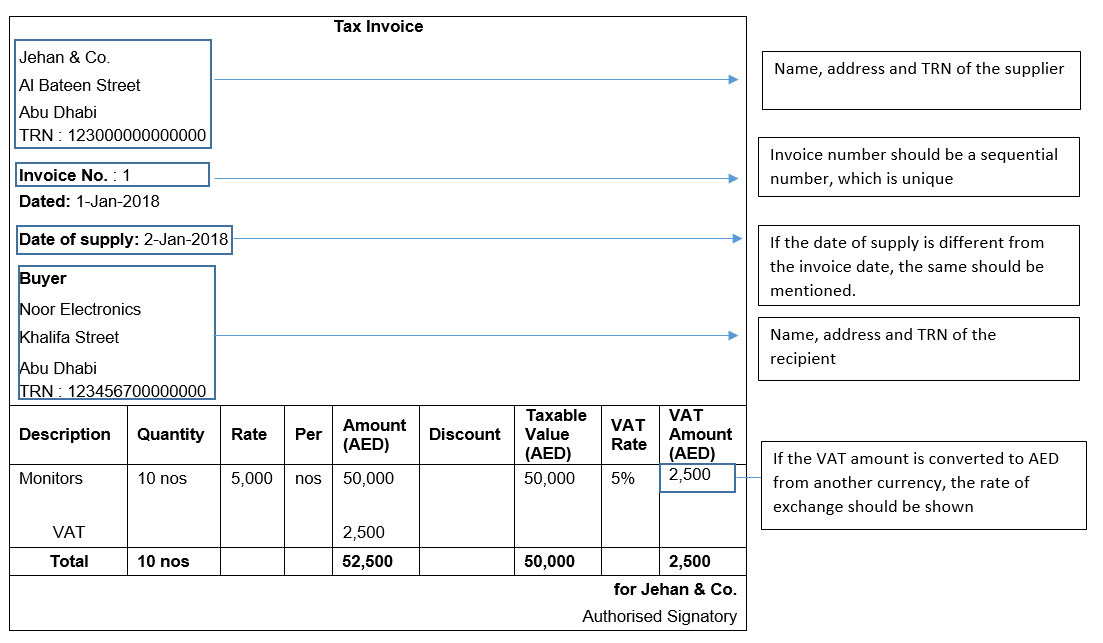

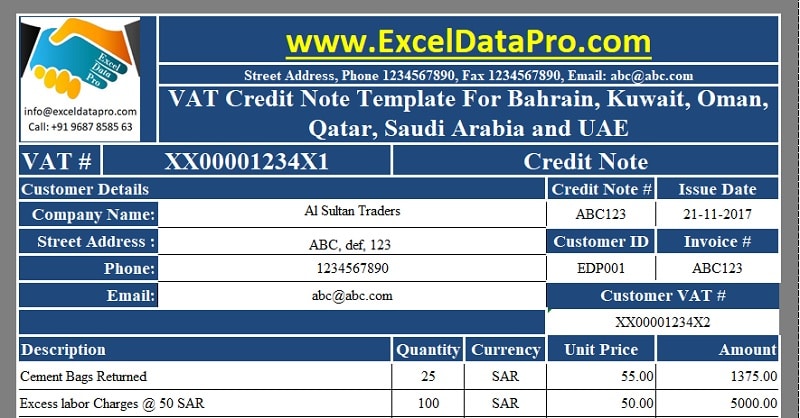

P o box 2056 jeddah 21451 saudi arabia or in case of system character limitation you may use below p g billing address. Pursuant to the provisions of the unified vat agreement the. In the article vat invoice in saudi arabia we learnt all about tax invoices including the details that are mandatory to be mentioned in a tax invoice.

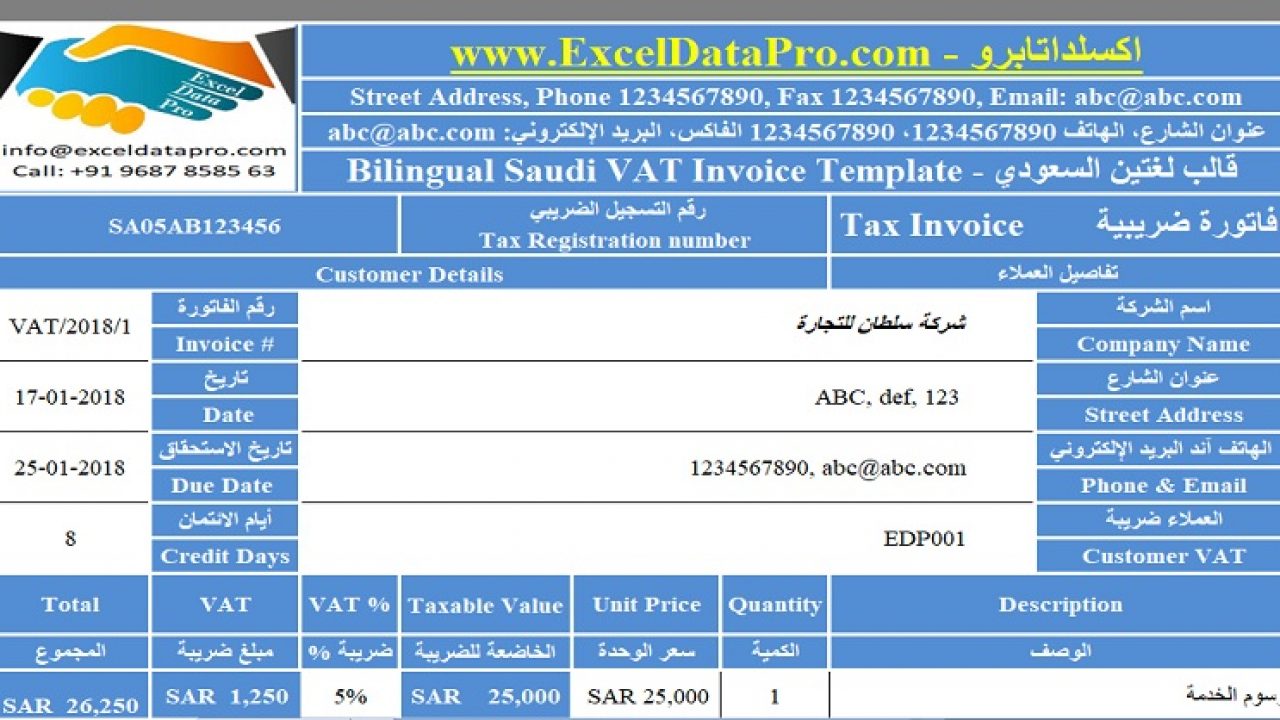

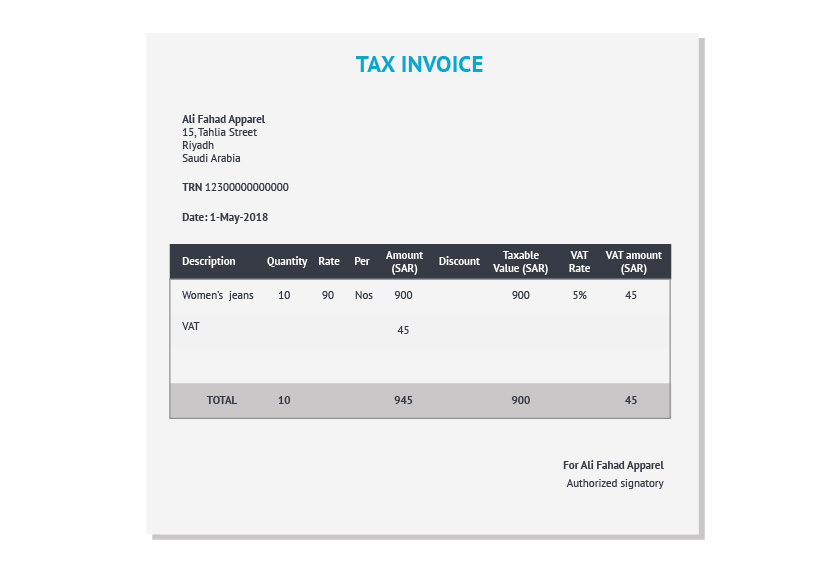

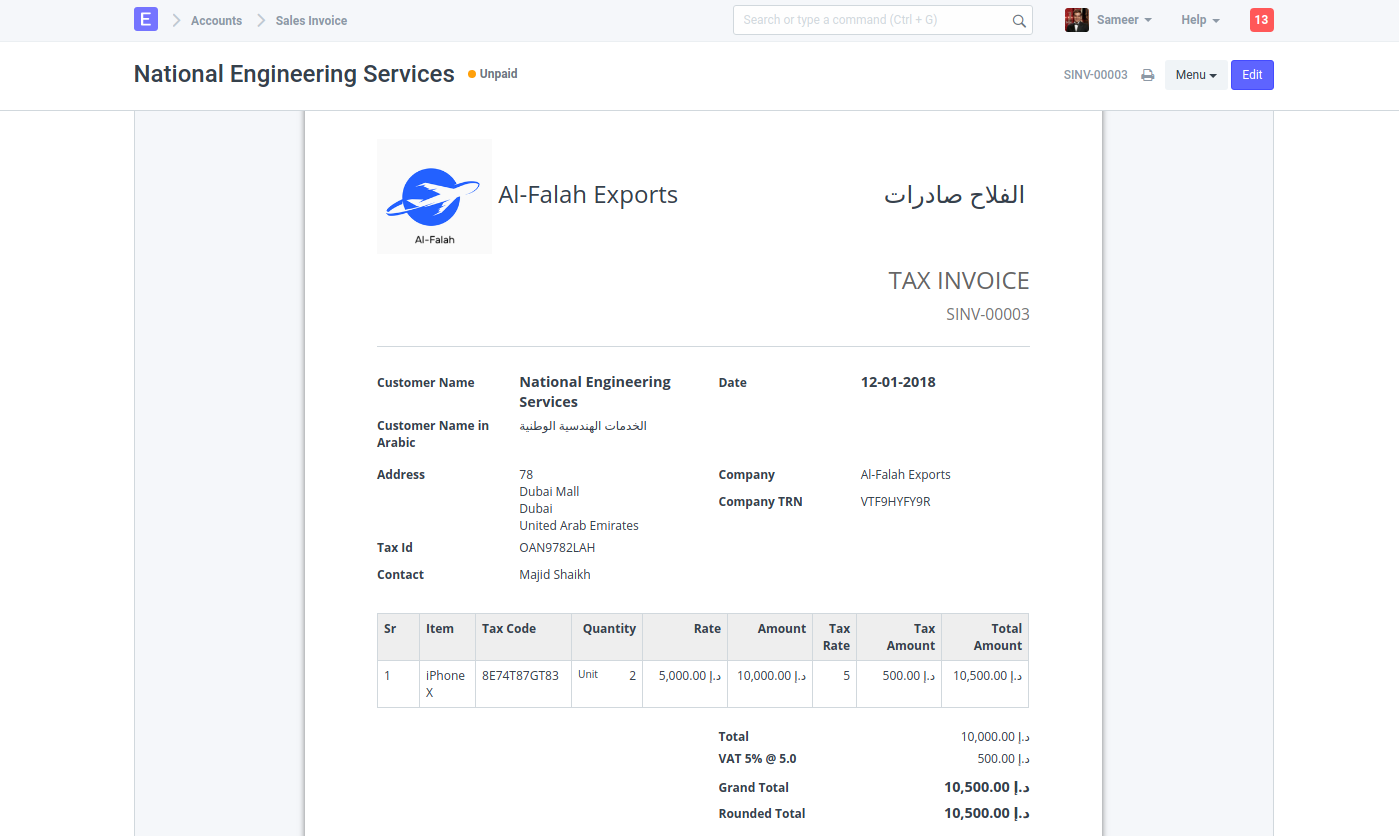

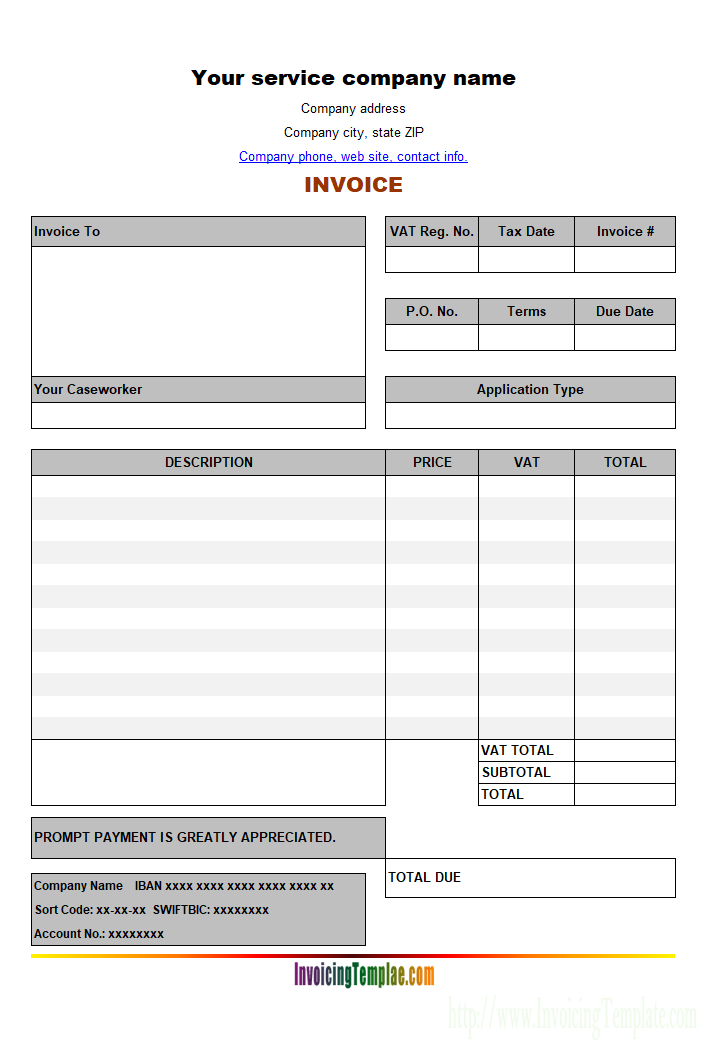

It is mandatory by saudi vat law that the tax invoices issued by business entities in saudi should issue bilingual saudi vat invoice. Vat invoice is the single most essential document to be issued by all registered persons under vat in saudi arabia. The first is a simplified tax invoice for the supply of goods or services with a total value of less than sar1 000 usd266 which must include the date of issue.

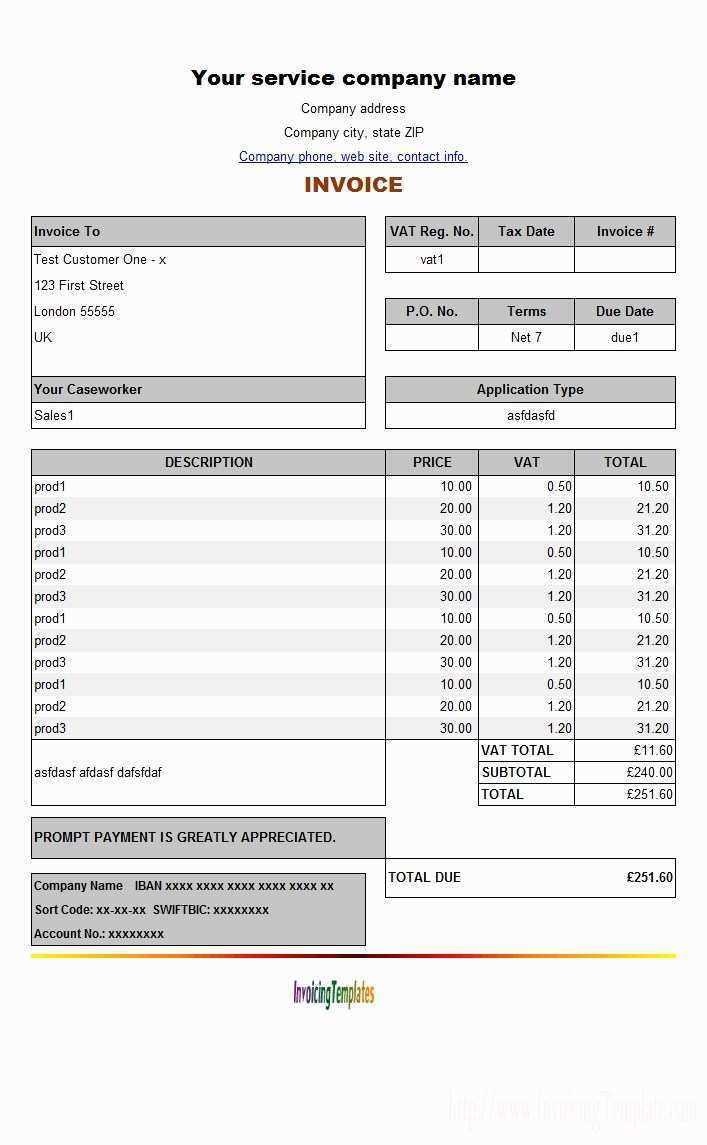

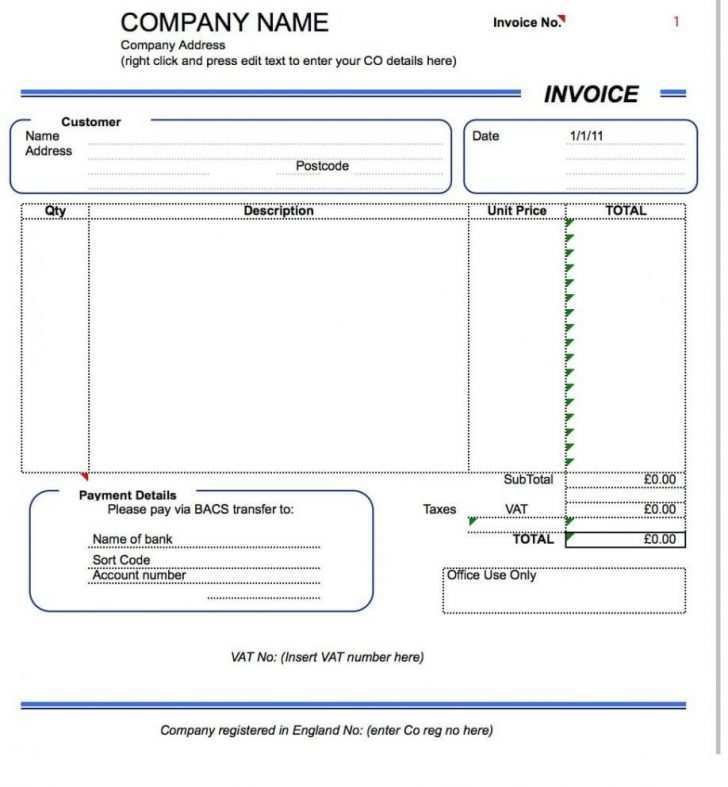

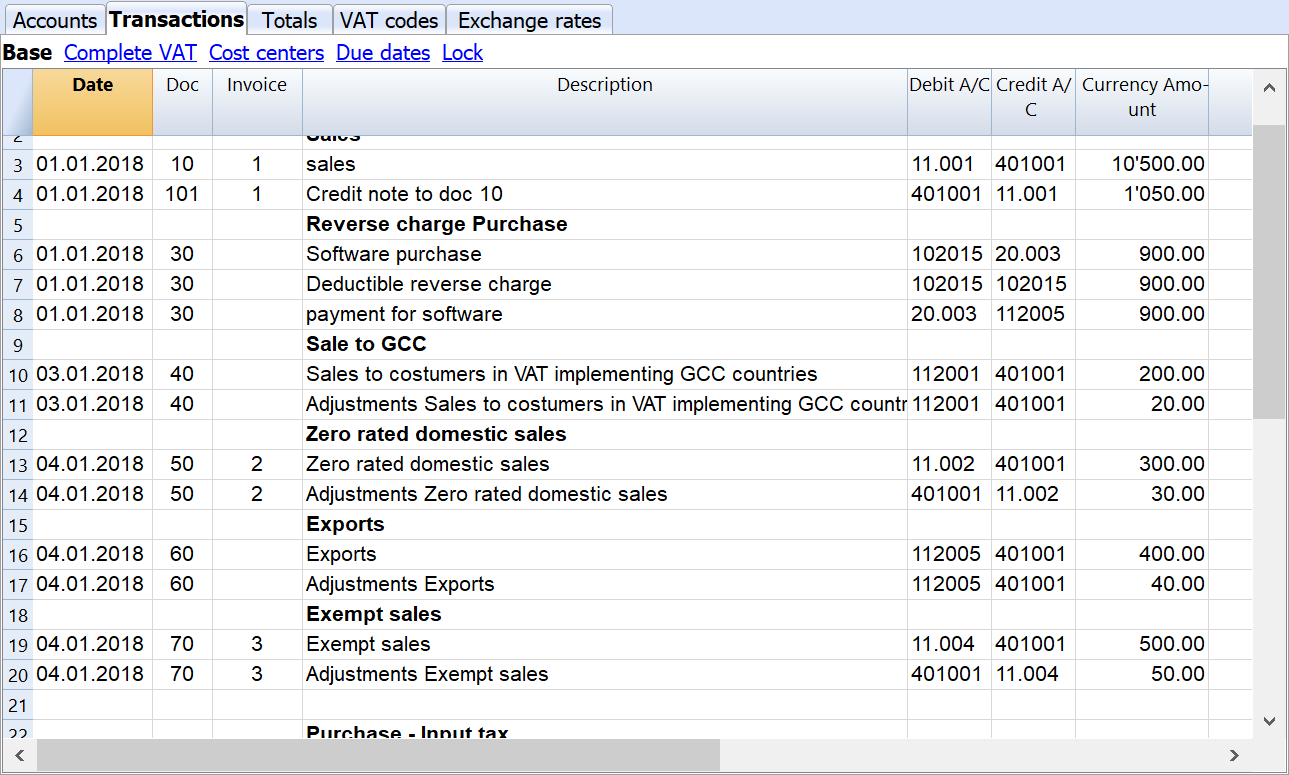

Add or edit the taxes from the set taxes button. And a clear statement of the tax payable or indication that the total. Details of the goods or services supplied.

Saudi arabian vat invoice requirements vat invoices must be issued for all taxable supplies and or related payments invoices must be issued by at least the 15 th of the month following the taxable supply. According to article 53 clause no 5 of implementing regulations under the saudi vat law. A tax invoice must include the details in arabic in addition to any other language also.

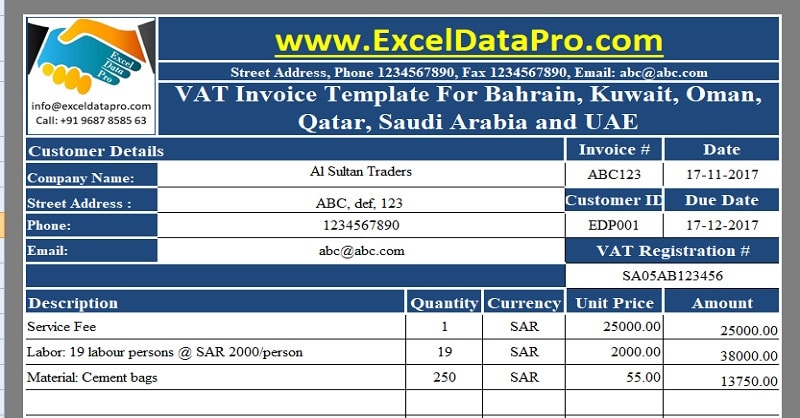

Vat invoice format in saudi arabia. A vat invoice is to be issued by registrants for all supplies of taxable goods or services. Implementing a value added tax vat system in the kingdom of saudi arabia ksa the unified vat agreement for the cooperation council for the unified arab states of the gulf the vat agreement was approved by the ksa by royal decree no.

Add discounts add more fields if applicable and print save as pdf or email the invoice to your client. In this article let us see a sample format of a vat invoice to be issued in ksa. The name address and vat identification number of the supplier.

Consideration to be received for goods or services. Simplified tax invoice may be used if invoice value sar 1 00 and should include only the issue date supplier name address and tin description of goods and services supplied the consideration payable for the goods or services and value of vat payable.