New Tax In Saudi Arabia 2018

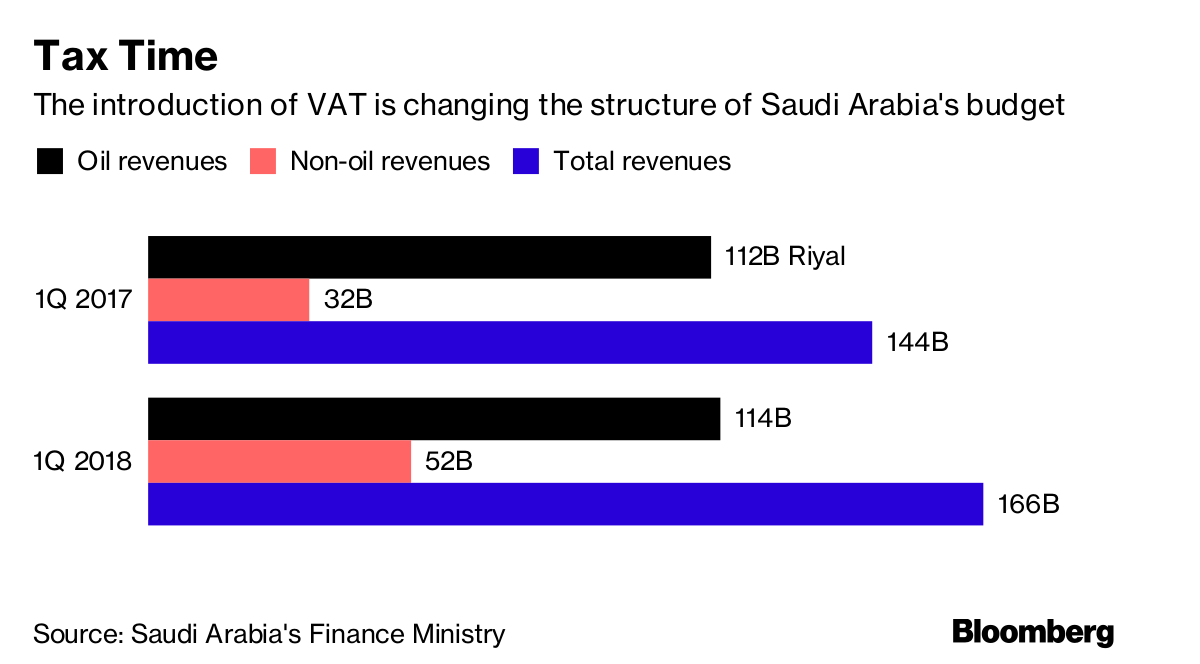

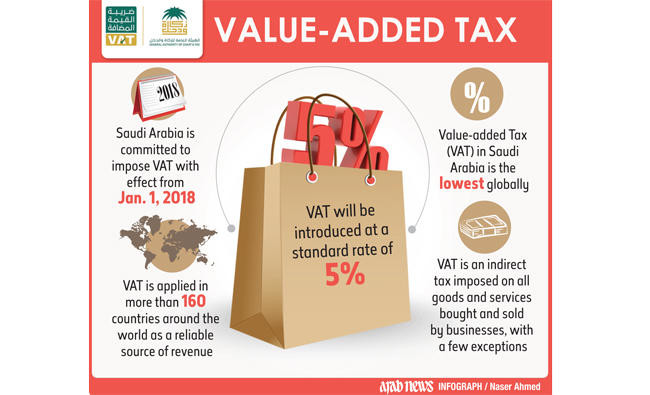

Saudi arabia and the united arab emirates are ringing in the new year with the introduction of a five percent value added tax vat on most goods and services in an effort to boost revenue and.

New tax in saudi arabia 2018. See withholding taxes in the corporate summary for more information on wht regulations. Kpmg al fozan partners a leading provider of audit tax and advisory services in saudi arabia has announced the appointment of wadih abounasr as the head of tax. New tax doubles price of cigarettes.

Once tax free saudi arabia will soon become a very. Who has been in saudi arabia for 24 years. Goods tax in saudi arabia.

In his new role wadih will be leading the tax function from kpmg al fozan partners headquarters in riyadh. See taxes on corporate income in the corporate summary for more information on the taxation of non employment income. The value added tax vat is 5.

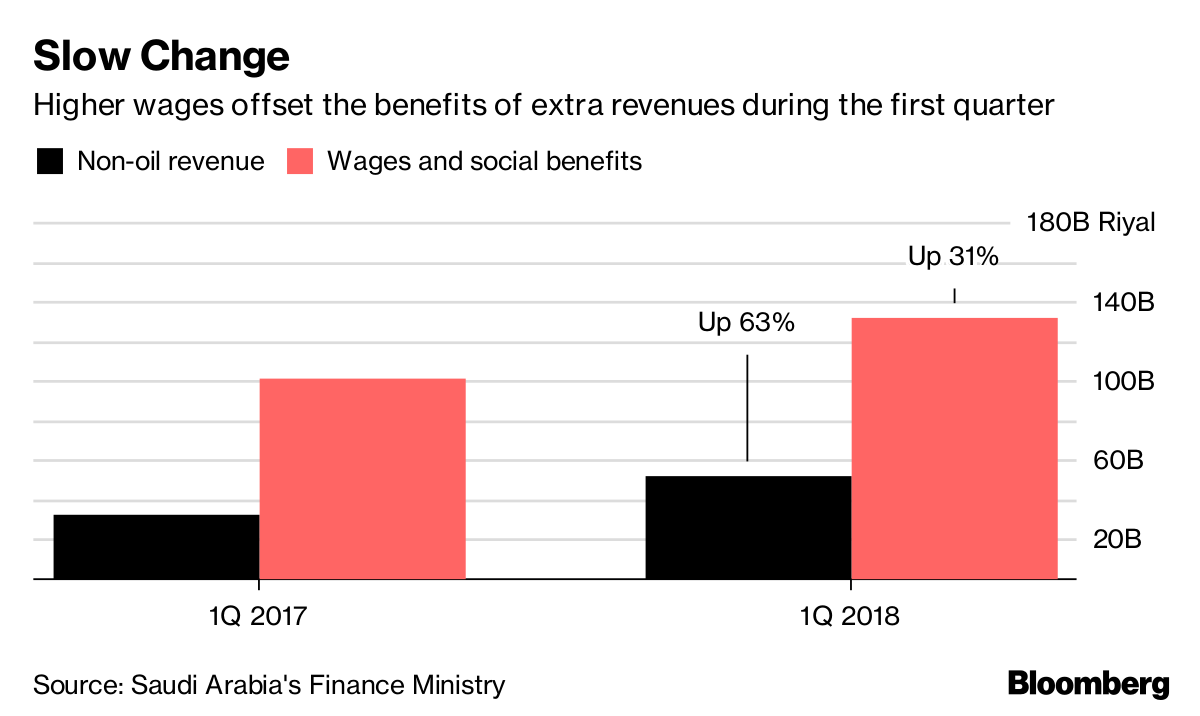

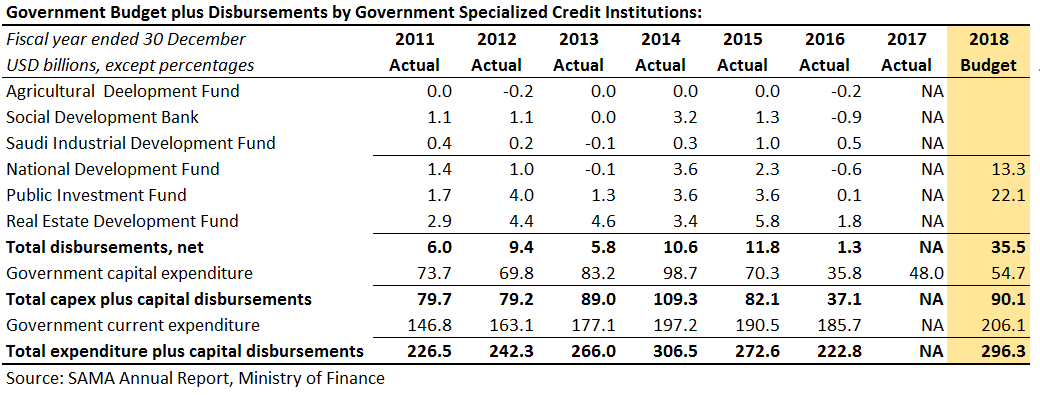

The vat was controversial enough when introduced at 5 in 2018. Generally non saudi investors are liable for income tax in saudi arabia. In saudi arabia s case the new tax rate and austerity measures are a seemingly appropriate response for a country that almost exclusively relies on a single sector to fund its government.

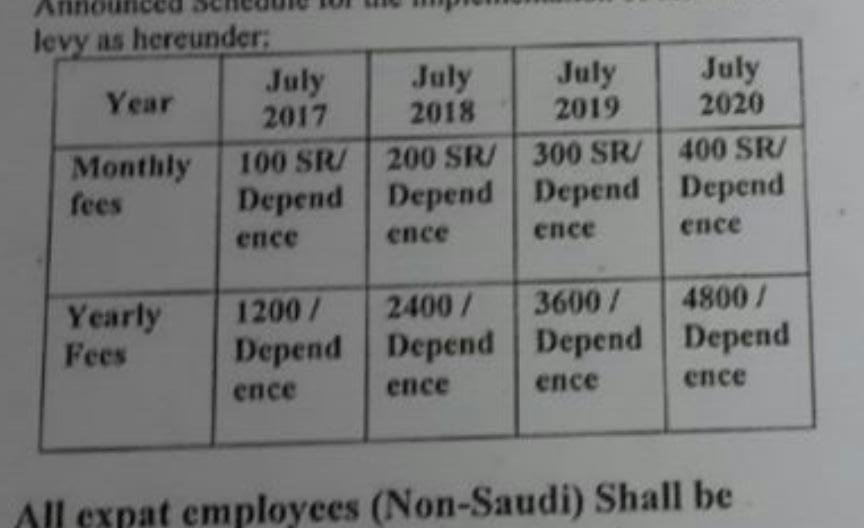

Saudi arabia collects new tax on expats from july saudi arabia is collecting a new tax from expats and their dependants a move that is seen to boost the country s revenues amid weak oil prices. Goods import in saudi arabia. The new fee will be 100 saudi riyals sar per dependant per month around 21 or 27.

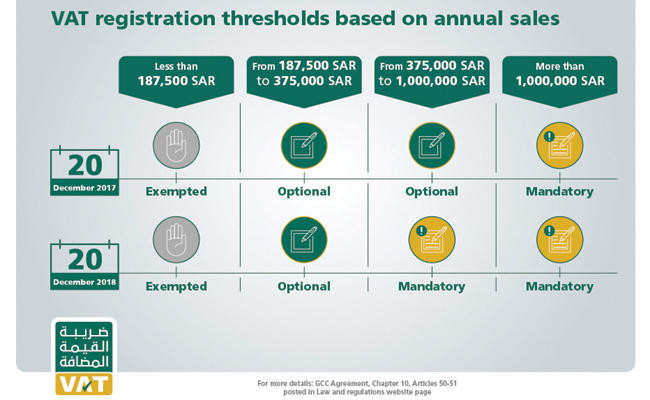

The new saudi arabia where taxes triple and benefits get cut. It could be assessed on commercial goods properties and other financial belongings. As of january 1 2018 the first time ever vat was applied to all goods and services in saudi arabia.

In most cases saudi citizen investors and citizens of the gcc countries who are considered to be saudi citizens for saudi tax purposes are liable for zakat an islamic assessment where a company is owned by both saudi and non saudi interests the portion of taxable income attributable to the non saudi interest is. Of 5 percent on certain goods beginning in 2018.